Have You Maxed Out Your Retirement Contributions

Finally, after what feels like an indescribable amount of time, we’re approaching the end of 2020. As you

prepare for the holidays, you may also need to take care of your year-end financial planning, including thinking

about maxing out your retirement contributions.*

Why Max Out Retirement Savings

There are potential benefits now and, in the future, if you increase or max out your retirement plan contributions.

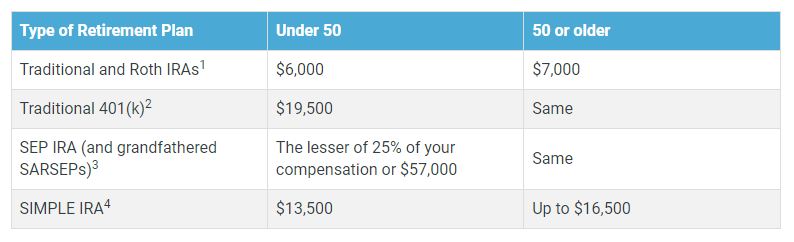

The most prevalent types of retirement savings plans are 401(k) plans and individual retirement accounts (IRAs). In

most cases, a 401(k) plan is employer sponsored while you open an IRA by yourself. They also have different maximum

contribution allowances.

Depending on your situation, you might have a choice between traditional and Roth retirement accounts. One of the

main differences between traditional and Roth accounts is when you pay tax on the money.

2021 Retirement Contribution Limits

You Don’t Want to Work Forever, Do You

According to a Pew Research Center survey, nearly two-thirds of working Americans don't plan to retire or they intend to work for as long

as possible5. The same survey also indicates that working after 65 is a choice for some Americans, but a necessity

for others6.

Stashing money in an employer-sponsored 401(k) plan or an IRA can be a great way to pad out your retirement savings.

Many people, especially Gen Xers and millennials, don’t think they’ll actually receive Social Security.7

And they might be right.

In 2020 the Social Security and Medicare Boards of Trustees projected in their annual report that one of the critical

trust funds that provides the funding for these programs is likely to be depleted by 2034.8 While tax income will

supplement the depletion of the fund, it likely won’t cover all of the demand.

Contributing to a private retirement plan like an IRA is one way to supplement Social Security, whether or not you

receive it when you reach retirement age.

Maxing Our Your Contributions Might Reduce Your Current Tax Burden

If you contribute to a traditional 401(k) or IRA, your contributions come from your gross – or pretax –

income. This potentially reduces the amount of income that you pay tax on now, although your distributions will be

taxed when you take disbursements later in life.

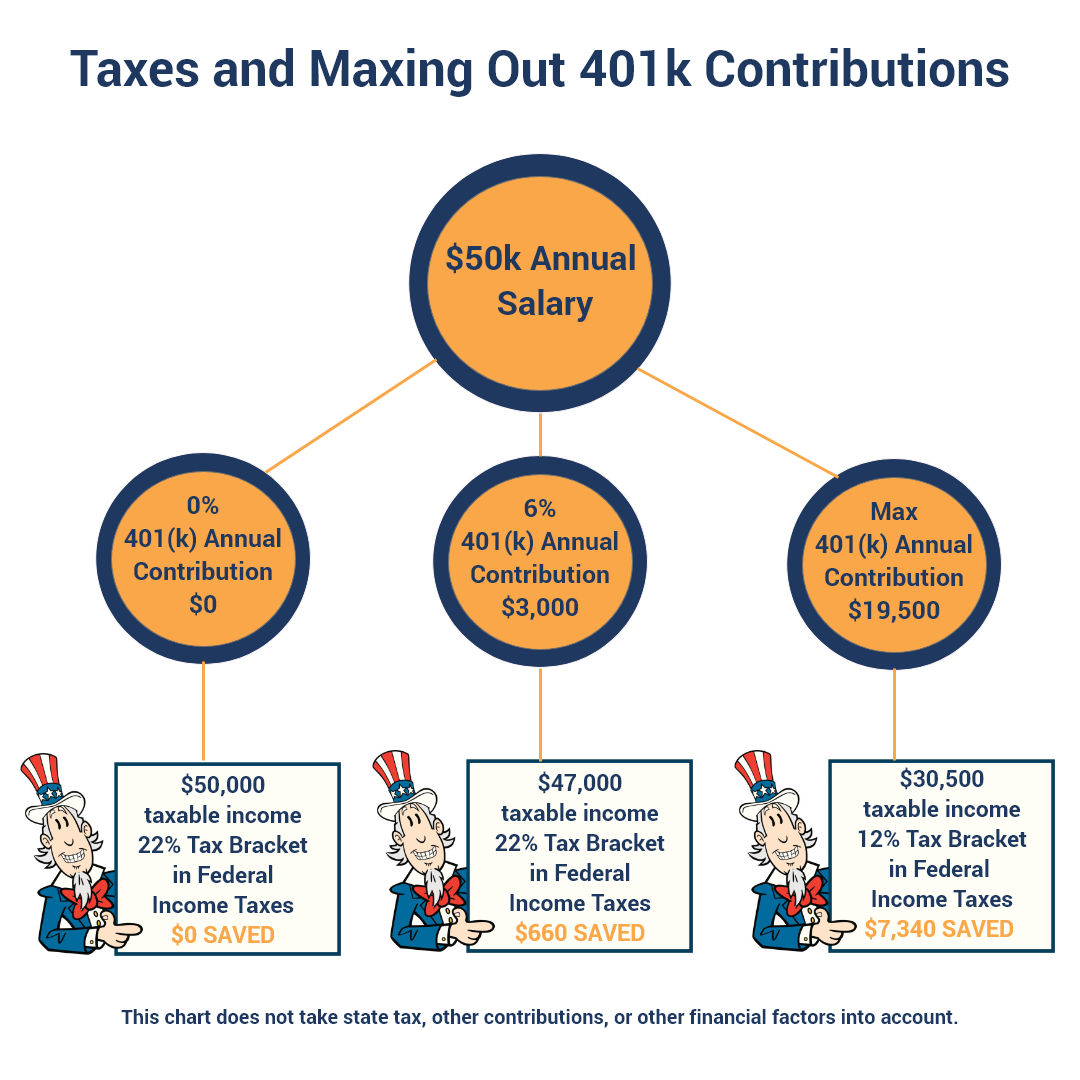

For example, suppose your salary is $50,000, based on the 2020

IRS tax brackets, your federal income tax rate is 22 percent, and you contribute 6 percent to your 401(k).

These calculations don’t take other factors into account, but consider:

While maxing out your deductible 401(k) contributions might not be possible for some people or possible every year,

increasing your contributions might create potential benefits now and in the future. Everybody has unique financial

needs, and there isn’t a one-size-fits-all approach.

Jake Hill, CEO of DebtHammer,

elaborates:

"If you have a high income with little to no potential for surprise costs, yes, you may wish to contribute as much as possible to your retirement plan each year. It will reduce your tax burden and will serve you better in the long run, especially with the potential for compound interest.

But most people won't have enough to justify that. If you're stretching your monthly budget to max out your retirement, you're going to find yourself in a bad spot if an emergency happens. You can cash out some retirement early, but you'll pay taxes on that sum and you'll lose money, as well."

Fortunately, Tax-Deferred Retirement Savings Aren’t The Only Option

Contributions to a Roth IRA (or 401(k)) come from your net – already taxed income. While they don’t do

anything to reduce your current tax burden, maxing out your Roth IRA can help you prepare for retirement – if

you can afford it. Additionally, here

at Axos Invest, we offer Managed Portfolios that use innovative algorithms to manage your IRA or investment

account. You can set up regular auto-deposits to help you reach your contribution limits.

While we highly recommend saving for your future, you should talk to your tax professional for personalized

information and advice about your tax burden and possible deductions.

References:

IRS IRA 2020 Contribution Limits, https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

IRS 401(k) Contribution Limits, https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits

IRS SEP Contribution Limits, https://www.irs.gov/retirement-plans/plan-participant-employee/sep-contribution-limits-including-grandfathered-sarseps

IRS SIMPLE IRA Contribution Limits, https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-simple-ira-contribution-limits

Federal Reserve Board, “Report on the Economic Well-Being of U.S. Households in 2014” (2015), https://www.federalreserve.gov/econresdata/2014-report-economic-well-being-us-households-201505.pdf.

Pew Research on Retirement, https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2018/11/when-do-americans-plan-to-retire

Gallup Survey on Social Security Expectations, https://news.gallup.com/poll/184580/americans-doubt-social-security-benefits.aspx

Social Security fund depletion, https://www.ssa.gov/oact/trsum/ IRS 2020 tax brackets: https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2020

* Axos Invest, Inc., and its affiliates do not provide tax, legal or accounting advice. This material has been

prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal

or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any

transactions.

Axos Invest, Inc. Investment advisory services provided by Axos Invest, Inc., an SEC registered investment advisor.

All rights reserved. For information about our advisory services, please view our ADV Part 2A Brochure, free of

charge, at https://www.adviserinfo.sec.gov/Firm/150953. Brokerage services are provided by Axos Invest LLC, a member

of the Financial Regulatory Authority (FINRA) www.finra.org and the Securities Investor Protection Corporation (SIPC)

www.sipc.org.

These views are subject to change at any time based upon market or other conditions. The information, analysis, and

opinions expressed herein are for general information only and are not intended to provide specific advice or

recommendations for any individual or entity.

Please keep in mind, past performance is not necessarily indicative of future results. All investments carry risk and

all investment decisions of an individual remain the responsibility of that individual.

This blog post was published by Axos Bank on September 24, 2021, and last updated on September 24, 2021.