3 Reasons You Need Early Direct Deposit

Everyone loves payday.

But, if you’re among the 7 percent of U.S. workers that don’t get paid by direct deposit – payday can be a major inconvenience. Thanks to long lines at the bank, lost checks in the mail, and the obligatory hold period you face when depositing a check, your real payday might not arrive until the following week.

In this post, we’ll explain why direct deposit is the best way to get paid. We’ll also show you how early direct deposit can help you get paid up to two days faster.

Here’s Why You Need Direct Deposit

Reason #1: It’s Convenient

Checks are a hassle.

When you get a paper check, you have to take the time to visit a bank or an ATM. If you use mobile deposits, you may need to wait 3-5 business days to get full access to your funds. You also have to be in the office to get paid – or wait for your check to come in the mail. This extra waiting time can add stress when paying the bills.

When you get paid with direct deposit, your bank account gets the funds on payday – no matter where you are. There are no hold periods or extra waiting time. You can also divide your paycheck between your checking and savings accounts.

With direct deposit, you can truly "set it and forget it." Once you set it up, you'll never worry about accessing your paycheck funds again.

Reason #2: It’s More Secure

Checks are a major security risk. They can get lost, stolen, and even counterfeited. In 2018, American banks faced $2.8 billion in deposit account fraud. 47% percent of that was due to check fraud. That's a whopping $1.32 billion worth of fraudulent checks!

If you get paid with paper checks, there’s a lot of potential for someone to steal it – whether you’re in the office, out shopping, or hitting the gym. And if you receive your paycheck by mail, there are plenty of people that can access your mailbox or reroute your paycheck.

Luckily, most employers and banks will try to work with you to replace a lost or stolen check. But the extra time spent recovering the lost check is a nuisance – especially if you have bills to pay.

Direct deposit is the safest way to get paid. Because the payment is electronic, it passes fewer hands between your employer and your bank account. If there are any issues with your direct deposit, you have an electronic record of each payment. You have access to all your past pay stubs, long after you receive the paycheck.

Reason #3: You Get Paid Faster – With Early Direct Deposit, You Can Get Paid Much Faster

Direct deposit helps you get paid faster. You get paid on payday, and the money is instantly yours to use. Your bank doesn't need extra time to process your paycheck – it’s processed before your payday. That means no extra waiting or worrying about checks getting lost or stolen.

In comparison, if you’re paid by check, you must wait another 3-5 business days for it to clear the bank. If you get your paycheck by mail, you'll have to wait yet another 2-3 days for it to be delivered … assuming it doesn’t get lost or stolen!

How does direct deposit work?

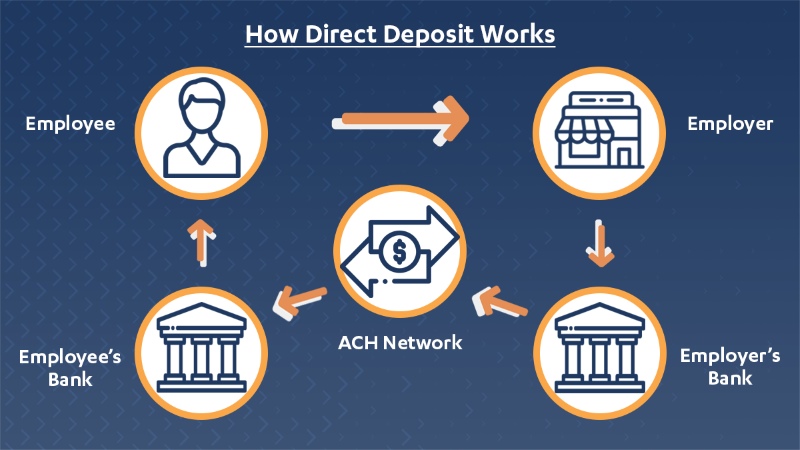

While direct deposit seems instant, it's a complex interaction between several financial institutions.

Here's a simple explanation of how direct deposit works:

Step 1: Set Up Direct Deposit – You start the process by giving your bank information to your employer. Many employers offer direct deposit forms during new employee orientation. Or you can get one directly from your bank. Axos Bank offers easy direct deposit enrollment online or in the mobile app. Go to Profile & Settings and select Direct Deposit.

Step 2: Send Payment Instructions – Before payday, your employer will send payroll instructions to their bank (or the Originating Depository Financial Institution (ODFI) in financial-speak). These payment instructions are sent via data files that contain routing numbers, bank account details, and transaction amounts.

Step 3: Pass Payment Information – After the employer's bank receives the data files, it passes the information to an Automated Clearing House (ACH). An ACH is a network of financial institutions that process bank-to-bank electronic transfers. Because banks handle a large volume of electronic transactions, they never send ACH payments individually. Instead, they batch up all of the day's ACH files to send to an ACH operator.

Step 4: Pass Payment Information (Again) – After the ACH operator receives your employer's payment instructions, it will organize all of its payment instructions to ensure each payment is sent to the correct bank. Like your employer's bank, the ACH operator receives a high volume of transactions that span many banks.

Step 5: Process the Payment – After your bank receives instructions, it will start the payment process. Essentially, this is a back-and-forth communication between your bank, your employer's bank, and the ACH to ensure your employer has the funds to clear the transaction. This spans 3-5 business days. Once the payment is settled, your bank will deposit your paycheck so you can enjoy your hard-earned funds.

Here's How Early Direct Deposit Works

It essentially works the same as regular direct deposit, except for one minor (albeit significant) difference – payment processing. Typically, after a bank receives payment instructions from the ACH, it will deposit your paycheck after it processes the payment. But with early direct deposit, the bank deposits the paycheck before it processes the payment, "on faith" that the employer's payment will clear.

Here’s an example:

Your coworker, Matt, has a basic checking account from ABC Bank. You, however, have an

Axos Bank Essential Checking account, which has Direct Deposit Express.

At your office, payday falls on a Friday. To make sure paychecks arrive on time, your employer sends payroll instructions to their bank Monday morning.

After your employer's bank and the ACH finish passing instructions, your bank and Matt's bank both receive the payment files on Wednesday. Both banks start processing the payment instructions.

But, while Matt is waiting for his money, Axos Bank deposits your money right away. Instead of getting paid on a Friday, you get paid on a Wednesday – two days faster than your coworker, Matt.

More Questions About Direct Deposit

Is direct deposit safe?

Yes! Because direct deposit is an electronic payment, it passes fewer hands while traveling from your employer to your bank account. That makes it the safest way to get paid.

Can I get paid on a weekend if I use direct deposit?

Typically, no. Direct deposit processes on business days. So, if your payday falls on the weekend, your bank will usually make the funds available on the Friday before payday or the following Monday (if it's not a federal holiday).

Will my direct deposit go through on a holiday?

Some employers will grant an early payday to ensure the holidays don't interfere with paychecks. But, regardless of your employer's payroll preferences, direct deposit only processes on bank business days. This means that you will get your paycheck the day before payday or the following business day.

Can my direct deposit go into a savings account?

Yes! You can choose the type of account you’d like your money to go to. When you set up direct deposit with your employer, bring the routing and account numbers and voided checks to verify all your accounts.

Is direct deposit the same as a wire transfer?

No. While direct deposits are processed overnight, wire transfers are processed and deposited instantly. This usually means that the wire transfer can be sent and deposited within the same day. (For international transfers, it usually takes an extra day or two to process.)

Unfortunately, this speed comes with a cost. Be sure to check with your bank or credit union for their fees – and see if there are any specialty accounts that waive wire transfer fees. For example, at Axos Bank, outgoing domestic wire transfers typically cost $35, and outgoing international wire transfers are typically $45. But there are some accounts where these fees are waived.

Get Started with Direct Deposit

Direct deposit is fast, convenient, and the safest way to get paid. And with Direct Deposit Express, you can get paid up to two days faster than your coworkers.

To take advantage of early direct deposit, sign up for our zero-fee Essential Checking account today.