Market Outlook: 5 Investing Tips for Tackling Inflation Head-On

COVID. Supply chain nightmares. Inflation. Now, the impact of the largest European land war since World War II. With oil prices and interest rates rising, it’s easy to see why many investors aren’t just worried about where to put their money amidst the chaos, they may be frozen on the sidelines due to their uncertainty.

It’s understandable. When financial markets are in turmoil and account balances start to fall, there’s a nearly instinctual temptation to “do something” to protect against any potential losses.

However, for those investors who can fight through the fear, this is exactly the time to stay in the markets to take advantage of the potential opportunities to come.

Axos Invest Senior Vice President Tracy Gallman councils that the key to long-term growth of wealth is to stay in the markets.

“Consider how you’ll feel if markets rebound, and you could have recouped all your money – and more. That’s why it’s best to stick to the long-term plan,” Gallman said. “Any changes should be made because of changes in your life, not fluctuations in the markets.”

And she points to some compelling evidence to back that claim.

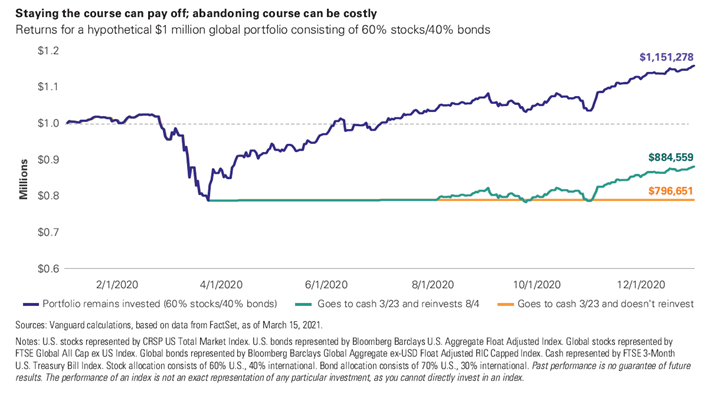

If you had $1 million in a 60/40 portfolio (60% stocks, 40% bonds) on Jan. 1, 2020, that investment would have suffered a nearly 20% loss in value by March 23, the day the U.S. stock market bottomed out during the coronavirus pandemic.

But sometimes the best move is the move you don’t make. According to Vanguard calculations, investors who cashed out during the depths of the plunge would have lost out on more than $350,000 in market gains over the following eight months vs. those who stayed invested.

“The financial markets are always an opportunity. It’s the approach to the markets that is the key to success for many investors,” Gallman said.

Understanding Inflation

Of course, another key factor in finding the courage to stick to your long-term plan is understanding what inflation is and how it occurs.

Inflation is a measure of how prices on goods and services rise or fall in an economy.

Meanwhile, a handful of factors impact the prices you pay. When there’s more demand than supply for a product, demand-pull inflation can set in – and companies raise prices in the face of the elevated demand. There’s also cost-push inflation, which happens when it becomes more expensive for a company to produce that good or service. Companies can raise prices to offset the higher costs.

While those market forces are pushing and pulling, governments and central banks can manipulate the money supply to help create balance between supply and demand. But if that balance is off and there’s more money chasing the same amount of goods, demand increases on the diminished supply and prices can start to climb.

Finally, the specter of inflation can itself be a factor in whether that rate rises or falls. If workers expect more inflation, they may demand higher wages to compensate. In turn, those wage increases can boost the cost of producing goods and services, resulting in higher prices.

Inflation: Here’s what you can do…

Once again, let’s be clear – it’s important to remember that inflation isn’t evil. In fact, the Federal Reserve sets an official inflation target of their own at 2%, a level of elevated, yet modest short-term demand where consumers expect prices to rise, so they buy now rather than paying more later. Sales increase. Employment grows. Factories boost production. And consequently, the economy benefits.

But it doesn’t take a lot for even modest inflation to start eroding purchasing power over the long haul. According to the Bureau of Labor Statistics, $1 in 1990 held the equivalent purchasing power of about $1.98 by late 2020. The average inflation rate was only 2.3% during that period, yet that $1 lost almost half of its purchasing power over those 30 years.

If the inflation rate accelerates at a more aggressive pace as it’s done in the past year, it can erode the dollar’s purchasing power. The price of goods and services spike, far outpacing wages and hitting some consumers especially hard, like those living on fixed incomes.

During the 2010s, inflation wasn’t a serious problem, remaining relatively low and increasing by a modest average annual rate of just 1.75%. But starting in 2020, along came COVID – and with it, economic factors that changed the financial landscape.

As restrictions loosened and the economy reopened in 2021, many consumers eagerly resumed their pre-COVID spending patterns. Government stimulus payments designed to boost the economy further during the lockdown days further fueled pent-up demand for goods and services.

Unfortunately, a global market racked with supply-chain disruptions and labor force upheaval wasn’t yet up to resume that torrid pace. Demand quickly outstripped supply, leading to elevated inflation that rose to 7.5% by February 2022. While that spike is well below levels seen in 1974, 1979, and 1980 when inflation exceeded 12%, it’s still enough of an economic punch for most Americans to feel it in their wallets, their purses, and of course, their investment portfolios.

Gallman is quick to point out that nothing can ever truly immunize a portfolio from the impact of rising inflation. Financial markets react fast to new information like rising inflation and adjust asset prices on the fly.

However, Gallman stresses there are some battle-tested practices to give the individual investor their best bet for dealing with inflation head-on.

-

Make sure your portfolio is a fit for you.

Current events aside, always invest in a well-diversified portfolio built to reflect your long-term return objectives and tolerance for risk. It may seem obvious, but there’s no investing goal more important. -

Don’t lose sight of true north.

While fear shouldn’t chase you out of the market, that doesn’t mean you should stand still. But when you decide change is needed in the wake of big market volatility, remain guided by your core principles. Don’t let today’s short-term fears move you into investments that don’t match your long-term goals.

-

Keep portfolio costs and expenses low.

This is good advice any time, but especially during heightened periods of instability. Being smart about your investing fees and expenses is good business during the best of times as well, protecting your assets from all those small, yet noticeable bites over time that cumulatively can take a big chomp out of the future size of your portfolio.

-

Trust in the relative efficiency of the financial markets.

It may not always look like it day to day, but the global financial markets do a pretty good job of making sure the latest information is reflected in pricing. You can rush to try to beat the market on breaking news but over the long haul, you can usually trust a market price is an accurate assessment of an asset’s true worth.

-

Screen out the noise and have patience.

While you should always stay abreast of what’s happening with your investments, don’t panic and overreact if they drop. More often than not, patience wins the day. Ride it out and you stand a better chance of earning back some – if not all – of what you would have lost from a panic move immediately after a stock tumbles.

(Be sure to also check out the rest of Tracy Gallman's further recommendations in this Market Outlook Extra, including some specific commodity-based ETFs to consider; as well as three key tactics for those building their retirement nest egg.)

Views expressed are as of March 15, 2022, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the author, as applicable, and not necessarily those of Axos Invest.

Axos Invest, Inc. Investment advisory services provided by Axos Invest, Inc., an SEC registered investment advisor. All rights reserved. For information about our advisory services, please view our ADV Part 2A Brochure, free of charge. Brokerage services are provided by Axos Invest LLC, a member of the Financial Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Commissions, service fees and exception fees still apply. Please review our commissions and fees for details.

Axos Invest, Inc., and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.