Start Investing Sooner

With all of our daily obligations, it's natural to feel like we're fighting the clock. But when it comes to

investing, time is your biggest asset. The sooner you invest, the longer the time your funds will have to potentially

grow.

If you start investing just a little bit of money regularly (think $5 - $50 a month), that money has the potential to

earn returns over time. If you reinvest those returns, they can earn even more returns. The sooner you start

investing, the more powerful $50 becomes.

On the other hand, if you delay investing, your money could lose buying power. That's because the longer you wait to

start investing, the more compound returns you're potentially giving up. Compounding happens when you earn returns,

and then those returns have the opportunity to earn returns and so on. Saving too little early on can make it much

harder to catch up later as you lose out on years of compound returns.

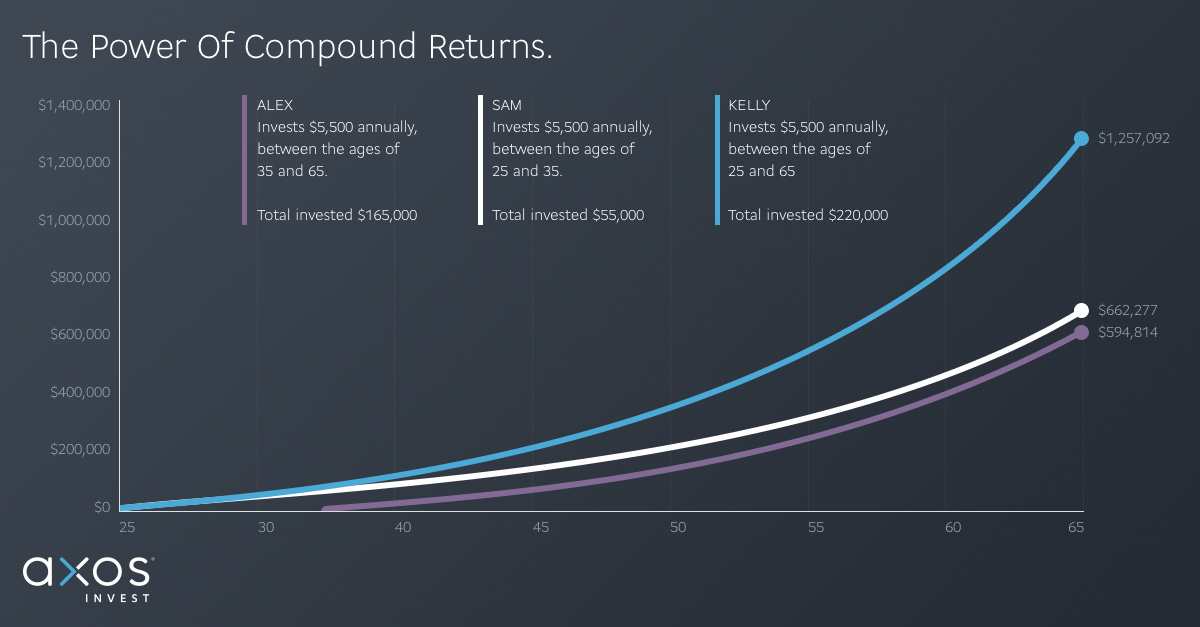

Take the following chart for example:

This chart is for illustrative purposes only and is not indicative of any investment. The chart assumes an initial

investment of $5,500 and an estimated interest rate of 7% compounded annually.

While Sam only invests $55,000 over 10 years compared to Alex's $165,000 over 30 years, Sam actually ends up earning

more money than Alex at age 65, since she started investing earlier with more time for compound returns.

You might be saying, "OK, I'll invest. But how do I know my money will earn these returns?"

No one can promise you guaranteed returns, and there is a risk of market fluctuations.* The primary way to beat the

effect of inflation is to invest for a better return than you can get in savings accounts. Investing in virtually

anything else inevitably involves greater risk than an FDIC-insured account. But you can choose investments that have

a level of risk you can tolerate. Returns on stock investments generally (think over the course of several years)

tend to beat inflation.

Having more time than money can add power to even the most modest of investments. So, don't wait, take advantage of

time. You can get started on an investment journey today by opening a Managed Portfolio or Self-Directed

Trading account now.

Axos Invest and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for

informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or

accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any

transaction.

Investing in securities involves risks, and there is always the potential of losing money when you invest in

securities. Before investing, please carefully consider your investment objectives, charges and expenses. Advisory

services provided by Axos Invest Inc., a registered investment advisor. Brokerage services provided to clients of

Axos Invest Inc., by Axos Invest, LLC a broker-dealer and member FINRA ("http://www.finra.org/"www.finra.org) / SIPC

("http://www.sipc.org)/"www.sipc.org). Investments: NOT FDIC Insured | No Bank Guarantee | May Lose Value. Axos

Invest, Inc., and Axos Invest, LLC are subsidiaries of Axos Financial, Inc., (NYSE: AX). All rights reserved.

For a free copy of our ADV Part 2A (Disclosure Brochure), please visit our page on the Investment Adviser

Public Disclosure.

This blog post was published by Axos Bank on September 14, 2021, and last updated on September 14, 2021.