Market Outlook Extra: Are Commodity-Heavy ETFs a Hedge Against Inflation

In addition to her key tips for battling inflation, Axos Invest Senior Vice President Tracy Gallman goes even deeper in this Market Outlook Extra, answering questions about some specific commodity-based ETFs to consider; as well as three key tactics for those building their retirement nest egg.

Q: For casual investors, conditions like these are bound to create financial and investing uncertainty.

Should investors consider shifting their approach to broader diversification via mutual funds and ETFs rather than chasing the volatility of individual stocks? Is there value in having exposure to non-equity assets?

If you are going to select your investments in the portfolio, then we suggest doing research on mutual funds or ETFs that are managed by an expert portfolio manager. Consider the manager’s philosophy, process, and performance in inflationary periods and deflationary periods.

A more specific way to implement ETFs is in commodity exposure. Here are some Focused Commodity Exposure ETFs you may want to research for your portfolio:

| Symbol | Company | Prospectus | Morningstar Rating* |

|---|---|---|---|

| GLD | SPDR Gold Shares | ☆ ☆ ☆ ☆ ☆ | |

| IAU | iShares Gold Trust | ☆ ☆ ☆ ☆ ☆ |

| Symbol | GLD |

| Company | SPDR Gold Shares |

| Prospectus | |

| Morningstar Rating* | ☆ ☆ ☆ ☆ ☆ |

| Symbol | IAU |

| Company | iShares Gold Trust |

| Prospectus | |

| Morningstar Rating* | ☆ ☆ ☆ ☆ ☆ |

Here are some Broad-Basket Commodity Exposure ETFs you may want to research for your portfolio:

| Symbol | Company | Prospectus | Morningstar Rating* |

|---|---|---|---|

| BCD | Aberdeen Standard All Commodity | ☆ ☆ ☆ ☆ ☆ | |

| CMDY | iShares Bloomberg Select Broad Commodity | ☆ ☆ ☆ ☆ |

| Symbol | BCD |

| Company | Aberdeen Standard All Commodity |

| Prospectus | |

| Morningstar Rating* | ☆ ☆ ☆ ☆ ☆ |

| Symbol | CMDY |

| Company | iShares Bloomberg Select Broad Commodity |

| Prospectus | |

| Morningstar Rating* | ☆ ☆ ☆ ☆ |

*Morningstar Ratings as of 01/31/2022. Ratings from 1 Star (lowest) to 5 Stars (highest)

Given the current situation with the Russia-Ukraine War coupled with high inflation, investors can also investigate quality bets, including cyclicals such as financials and industrials. Underweight defensive sectors such as utilities and consumer staples. U.S. stocks are likely to outperform international stocks in environments like we are experiencing now. The key is staying very diversified with equal weight positions. Don’t take large bets, focus on value and quality companies and opportunities.

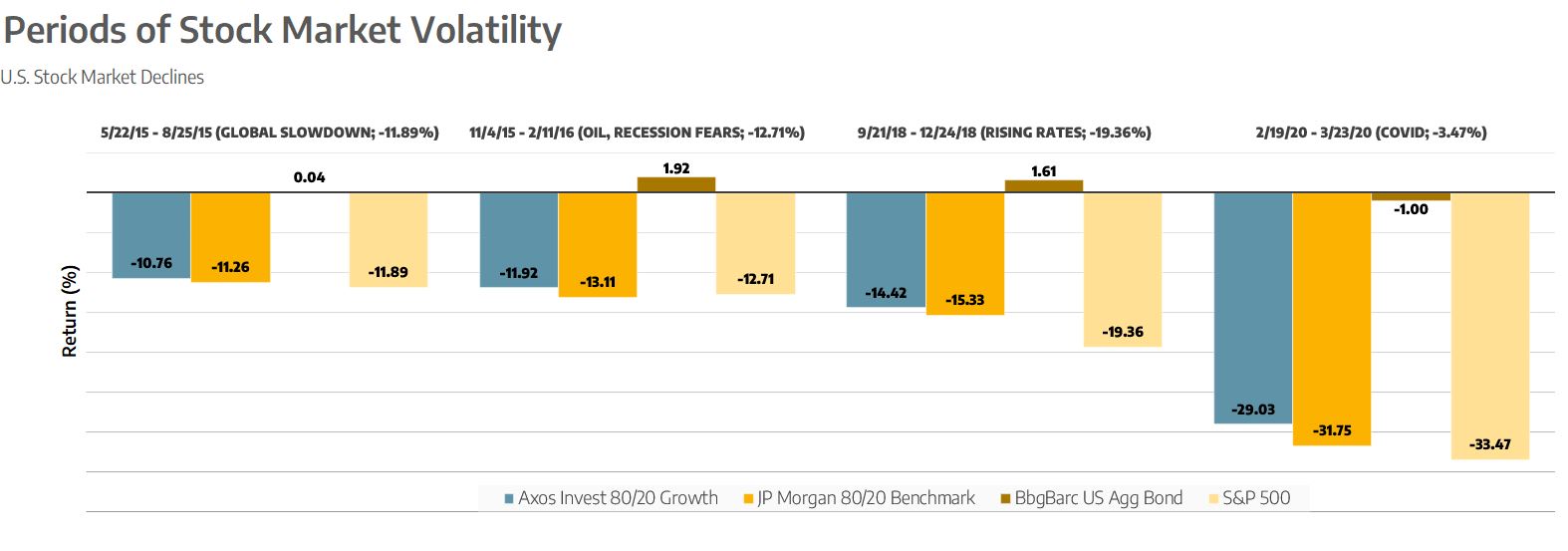

Axos Managed Portfolios provide access to TIPS and REIT ETFs that deliver asset class diversification and mitigate overall portfolio downside risk. These ETFs are strategically allocated into the portfolio and the weights to the asset classes are determined by the risk objective you choose for your portfolio. After almost 11 years of performance history, the Axos 80/20 Growth model has proven itself to limit the downside risk of the portfolio during times of market volatility.*

The event chart below demonstrates that during periods of stock market volatility, the Axos 80/20 Growth model outperformed the S&P 500 and other comparative equity/fixed benchmarks.

Q: Since inflation could be with us for a while, how about those nearing their planned retirement age? What should they consider to manage their finances and securities portfolios? Could this influence their heirs?

Growth is key for retirees; it’s the only way to outpace inflation. When a client is creating a portfolio for retirement, it is important to move away from traditional asset allocation and look at the investing through a different perspective. We would encourage investors to design their portfolios around the amount they believe they will need to spend. The strategy would potentially include a higher allocation to stocks, which would be balanced by a risk mitigation position in the portfolio. The risk mitigation position is designed to take your portfolio out of the market when there is volatility. The goal is to minimize loss as much as possible.

Finally, the strategy would include a reserve of cash; perhaps up to 3 years of desired spend. Creating a portfolio using these 3 key techniques can help you achieve your retirement distribution or income goal. Another option for clients is to look at different types of dividend equity portfolios or equity/fixed income-oriented portfolios that deliver consistent dividend growth year over year. Saving early, leveraging Traditional and Roth IRAs, as well as 401(k) plans, and creating a sound strategy for diversification and risk management are key consideration in developing any retirement strategy.

Views expressed are as of March 15, 2022, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the author, as applicable, and not necessarily those of Axos Invest.

Axos Invest, Inc. Investment advisory services provided by Axos Invest, Inc., an SEC registered investment advisor. All rights reserved. For information about our advisory services, please view our ADV Part 2A Brochure, free of charge. Brokerage services are provided by Axos Invest LLC, a member of the Financial Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Commissions, service fees and exception fees still apply. Please review our commissions and fees for details.

Axos Invest, Inc., and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

*The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. Current performance may be higher or lower than the performance data shown. For performance current to the most recent month-end, please call 1-800-480-4111.

The display of stress test charts is dependent on the availability of daily returns data, and on the longevity of track record for the investments in the portfolio and the benchmark. See Definitions - Stress Test page for further details on period selection.

Past performance is not indicative of future returns. Performance does not include any sales charges or other expenses. The output is based on inputs provided by the user of the tool. All outputs are provided for informational purposes only and are not designed to be a recommendation for any specific investment product, strategy, or other purposes. By receiving this output, you agree with the intended purpose described above. No Axos Invest, Inc. affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other financial professionals that consider all of the particular facts and circumstances of an investor’s own situation.