3 Reasons Why You Need Cash In Your Portfolio

UPDATE: March 11, 2020

With the recent volatility in the financial markets, smart investors are increasing their cash holdings. They do so for two reasons: first, a healthy amount of cash allows investors to protect portfolios against further market declines. Second, with enough liquidity, investors can increase stock holdings when valuations reach more attractive levels.

To learn more about the benefits of keeping cash in your portfolio, we invite you to continue reading the article below. Then, consider protecting your portfolio with Axos Bank’s High Yield Savings account.

Think cash is trash?

Think again.

In today’s bull market, it’s popular to denounce the ails of the “cash drag.” After all, your money can earn far higher interest elsewhere and cash will never pay dividends.

However, savvy investors also understand that cash can play a vital role within a diversified portfolio.

Although we are witnessing one of the longest bull markets in history, as with all markets, this bull market will end. When it does, you will wish you had plenty of cash on hand.

Moreover, some of the country’s most famous investors are quietly holding unusually large reserves of cash.

Warren Buffet’s Berkshire Hathaway is holding $116 billion in cash and equivalents – far more than his usual $20 billion. Likewise, Margin of Safety author Seth Klarman is holding 40% of his assets in cash while Fairfax Financial’s chief executive, Prem Watsa, is reserving 43% of his own portfolio in cash.

If cash is as worthless as popular opinion suggests, why are some of the country’s most famous investors dedicating large portions of their portfolios toward holding it?

We have an idea.

Below, we’ve listed three reasons why cash should be a vital component of your investment portfolio:

Peace of Mind

Cash is your ultimate insurance against a volatile financial market.

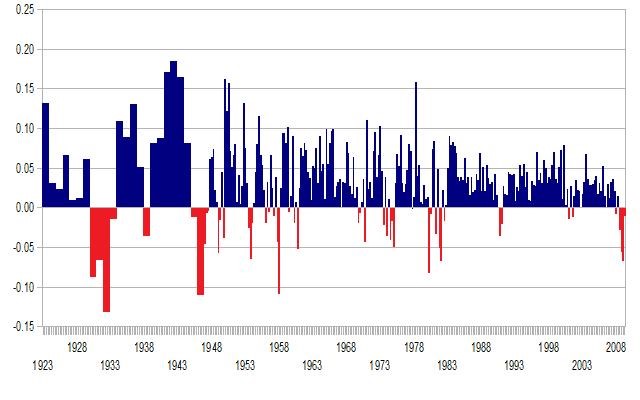

Recessions, bubbles, and market crashes are all part of the business cycle. In fact, recessions in the United States occur every 5 to 15 years. (For reference, take a look at the graph to your right which maps annualized GDP growth in the U.S. from 1929 to 2009. Each red mark indicates a recession.)

Unfortunately, people get into trouble when their entire wealth is held in the financial market. Intellectually, people understand the need to diversify one’s portfolio. However, many attempts toward diversification are limited to diversity among various stocks and bonds. Of course, this type of diversification is important, but a savvy investor will diversify even further.

Let’s compare two portfolio examples:

| Susan With Cash Hedging | Bill Without Cash Hedging | |

|---|---|---|

|

Stocks |

$250,000 | $500,000 |

| Cash |

$250,000 | $0 |

| Total |

$500,000 | $500,000 |

In this example, Susan has hedged her portfolio with 50% cash. Bill, on the other hand, has dedicated 0% of his portfolio to cash assets.

Now, let’s take a look at what happens when stocks lose 33% of their value (the average of past recessions since 1929):

| Susan With Cash Hedging | Bill Without Cash Hedging | |

|---|---|---|

|

Stocks |

$167,500 | $335,000 |

| Cash |

$250,000 | $0 |

| Total |

$417,500 | $335,000 |

| % |

-16.5% | -33% |

As you can see, because Susan hedged her portfolio with cash, she only lost 16.5% of her value while Bill lost a whopping 33%.

Cash is an easy solution to protect yourself against the natural ebbs and flows of the market. While other investors panic and lose further value by selling stocks at a loss, you can rest assured that you have enough assets to ride out the storm.

But What about Bonds?

Bonds are a great tool for hedging your portfolio. However, no bond is 100% “safe.” While bonds may not experience the same waves and crashes that stocks endure, bond values do fluctuate. In fact, they have a pesky habit of losing value as soon as interest rates rise.

Let’s take a look at another example:

Martha purchased a $1,000 bond from ABC Company with a 5% coupon. Because of the coupon, she receives $50 in interest every year.

Interest rates have risen and now ABC Company is offering $1,000 bonds with a 7% coupon.

If Martha wants to sell her bond, she must compete with newer bond holders. Unfortunately for Martha, buyers prefer to purchase bonds with a 7% coupon.

Martha now must sell her bond at a discount, which means her bond has lost value.

Ability to Seize New Opportunities

Financial advisors like to call this type of cash, “dry powder.” It’s a borrowed term from the 17th century, when military battles were fought with muskets and cannons. These weapons were powered by gunpowder, which needed to stay dry in order to remain effective.

If, for whatever reason, a military’s gunpowder reserves were moist, their entire artillery would be rendered useless. As you can imagine, this was a terrible spot to find oneself when facing a raging battle. With this in mind, military units kept plenty of dry powder on hand to stay prepared.

Just as a military needs dry powder to make an attack, you will need cash reserves to seize an opportunity.

For instance, most people understand that the Great Recession was a tumultuous period for wealth. Indeed, they may have this knowledge first-hand - on average, an American household lost a third of its net worth during this time.

However, for individuals whose entire wealth was not tied up in the housing or financial markets, this period represented great opportunity.

Take Amazon, for example.

If you had purchased Amazon stock on September 19, 2008 – four days after Lehman Brothers filed for bankruptcy – you would have bought it at $81 per share. Today, Amazon stock trades for $1,603 – an increase of 1879%. If you had only purchased 15 shares – a total of $1,215 – those shares would be worth $24,045 today.

As this example demonstrates, new financial opportunities can catapult your wealth. However, if you do not have enough cash in reserve, these rare opportunities will pass you by.

If you purchased 15 shares ($1,215) of Amazon stock in 2008, they would be worth $24,025 today.

Liquidity When You Need It

Medical expenses, job losses, household repairs, and legal fees – these types of unexpected emergencies can happen to anyone at any time.

If your entire wealth is tied up in non-liquid assets, such as a 401(k), IRA, or even your mortgage, your only option is to turn to debt. As you likely know, holding cash is far less expensive than holding debt.

Your solution to protecting yourself against these emergencies is cash reserves.

Cash, Not Cash Equivalents

When discussing the term “cash,” people often use it interchangeably with the phrase “cash equivalents.” However, a poor understanding of the difference can put you in a rather uncomfortable situation.

Cash refers to the most liquid assets that can be exchanged for goods and services, including:

- Coins

- Currency

- Checking accounts

- Savings accounts

- Bank drafts

- Money orders

On the other hand, the term cash equivalents refers to financial instruments that must be converted to cash. This includes:

- Treasury bills

- Short-term government bonds

- Marketable securities, including: certificates of deposit or common stock

- Money market funds

- Commercial paper

While cash equivalents can be a vital component of your portfolio, actual cash will be far preferable during an emergency.

For example, imagine that you have just arrived at your doctor’s office with an extreme medical emergency. Which would rather have in your possession - $5,000 in currency or $5,000 in commercial paper?

While commercial paper can be converted to cash, actual currency will be far more useful at this dire moment.

How Much Cash Should I Allocate?

Unfortunately, there isn’t a one-size-fits-all approach for determining how much of your portfolio should be allocated to cash.

Investors may hold anywhere from 6 to 30% in cash. How much you allocate depends on your tolerance for risk, investment goals, and your time horizon.

At the very least, you need two different types of cash allocations:

-

Emergency Fund: A cash reserve dedicated to emergencies will allow you to live a relatively comfortable lifestyle while weathering out your uncomfortable situation.

Save at least six months’ to a year’s worth of expenses and keep the money separate from your day-to-day spending account (lest you fall to the temptation of spending your emergency money). Be sure to add additional funds each year to prevent inflation from eroding its value.

Consider keeping your emergency fund in an online bank. Because these branchless banks have lower overhead costs than traditional banks, they provide higher interest yields to their customers. Moreover, if the online bank is FDIC insured, each account will be protected for up to $250,000.

-

“Dry Powder” Fund: Be sure to dedicate a portion of your portfolio toward seizing new opportunities. Unlike your emergency fund, your dry powder fund can be stored in cash equivalents to capitalize on higher interest yields. These cash equivalents should include money market accounts or short-term CDs, so your money remains stable as the market fluctuates.

Be sure to not dedicate too much of your portfolio to cash. Hedging is important, but you still want to reach your investing goals. Because of inflation, “cash drag” is a real concern.

Determine how much risk you can tolerate, then allow your wealth to multiply.

Protect Your Money with Axos Bank

Are you ready to defend your wealth against market volatility? Let Axos Bank help.

We offer customized solutions for your banking needs. As a digital bank, our operation costs are lower than traditional banks. This means better interest yields for your cash and lower interest rates for your loans.

3 Reasons Why You Need Cash In Your Portfolio

This blog post was published by Axos Bank on December 18, 2018 and last updated on March 11, 2020.