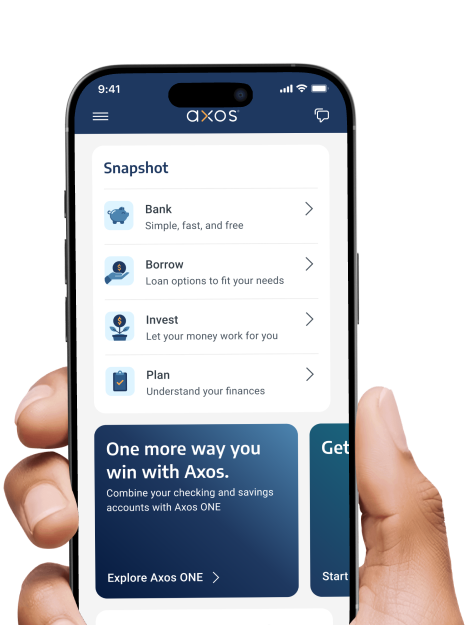

Born digital. Built different.

For 25 years, we've been redefining what's possible for financial services—from pioneering digital-first solutions to building a complete financial ecosystem that evolves with you.

Among the Best Online Banks | 2022

Forbes

Best Checking Account for High Interest

Nerdwallet

Best Checking Account Overall

Motley Fool's The Ascent

America's Best Online Bank

MyBankTracker

Best Online Bank for Savings & Checking

Millennial Money

Fully-digital banking was born.

While others built branches, we built the future—launching as one of the first fully digital banks on July 4, 2000. Our launch date was intentional as it symbolized freedom from banking as we knew it.

Total Bank Assets

Going public.

On March 31, 2005, we went public, proving that digital financial services wasn’t on the way, it was here.

When the markets closed that day, our stock was trading at $2.81. It’s been a steady upward journey since then.

Total Bank Assets

Building

what's next.

2009 to 2014 were full of milestones: award-winning Rewards Checking, game-changing lending solutions, and purposeful products for businesses, advisors, and clients. We weren't just adding services—we were becoming a financial partner for every moment.

Total Bank Assets

Broadening

our banking capabilities.

Two years of engineering. One seamless migration. Our Universal Digital Bank went live for nearly every customer. We also launched personal loans, auto financing, and trustee services. Then acquired Nationwide Bank, bringing our platform to their customer base.

Total Bank Assets

Expanding horizons.

COR Clearing gave us institutional trading strength. WiseBanyan brought intelligent automation. Together, we created Axos Clearing and Axos Invest—delivering efficient execution backed by a high-touch, client-first service model with dedicated specialists from onboarding through day-to-day support.

Total Bank Assets

Growth that serves.

From 2020 to 2025, we scaled our commercial banking capabilities through strategic growth—the acquisition of our Zenith business and expansion into Fund Banking and Technology & Life Sciences. We also introduced white‑label banking for RIAs, enabling firms to deliver branded banking experiences powered by our digital infrastructure and a client‑first service model.

Total Bank Assets

Empowering advisors.

We transformed E*TRADE's advisor platform, formerly Trust Company of America, into Axos Advisor Services— delivering custody without the constraints. With flexible integrations, transparent pricing, and technology that enhances workflows, we started equipping RIAs with infrastructure that supports their independence.

Total Bank Assets

Building for tomorrow, today.

What started as a goal to build better banking has evolved into a financial powerhouse. Stable. Dependable. Growing. Today, we serve everyone from first-time savers to big businesses with the same innovative spirit that launched us 25 years ago. This is just the beginning.

Total Bank Assets