Welcome to your first look at the new Axos Bank website

Founded on Independence Day in the year 2000 as “Bank of Internet”, we have grown to over $20.3 billion in assets and deposits. In anticipation of joining the New York Stock Exchange (NYSE: AX), we changed our name, logo, and tagline to reflect our growth and evolution as the premier leader in pro-consumer banking.

“Banking, Evolved” is more than a slogan – it encompasses everything we do. By providing our customers with tools, information, and low-cost resources, we empower them to make real progress toward their financial goals.

How will this change impact the bank customers?Don’t worry – we don’t want to interfere with your banking. Instead, we want to improve it.

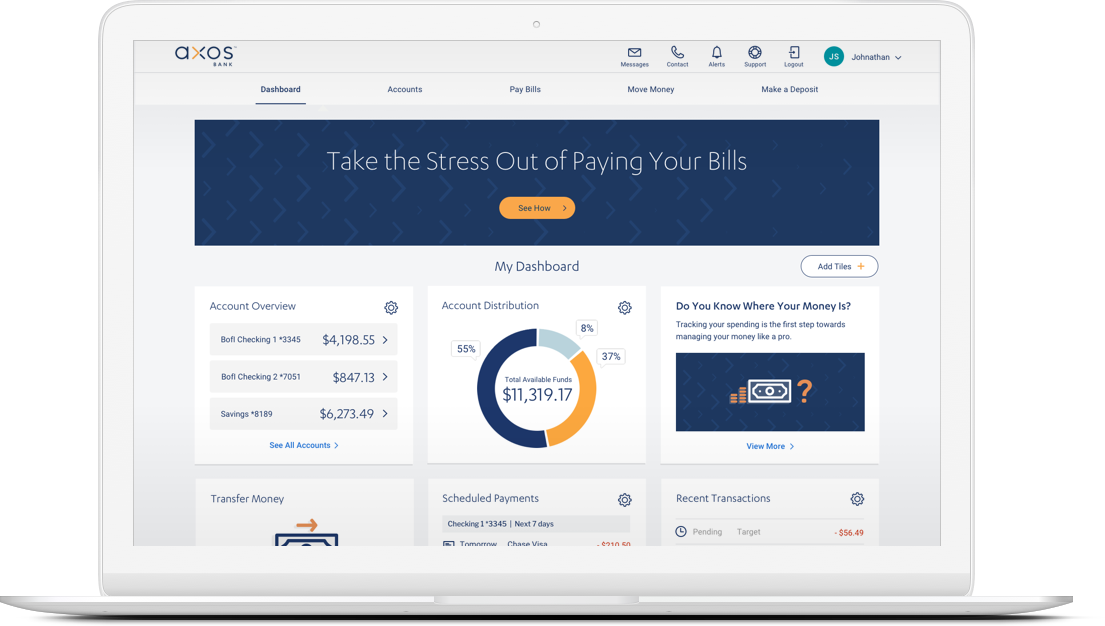

With our new design, we will roll out new technologies, customized products, and customer service features to enhance your banking experience.

In the meantime, your current account features, account number(s), and routing number will stay the same. Your FDIC insurance will remain in place and you can continue accessing your funds using your existing ATM cards.

How do I pronounce Axos?It’s pronounced “ak-sohs.”

What is Axos?

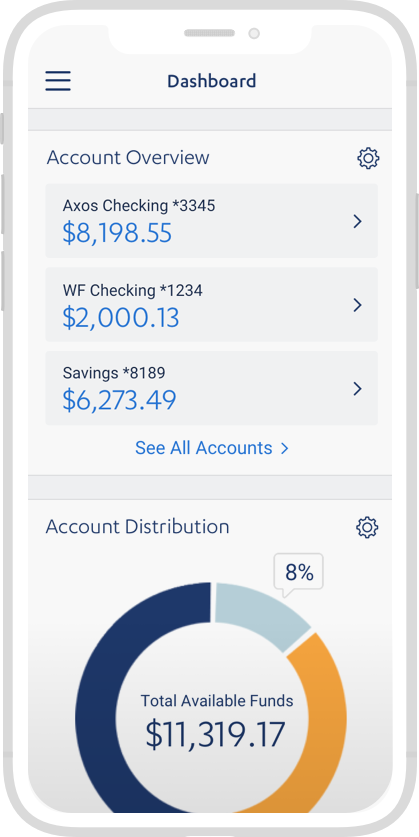

Our goal is simple - to provide customers with the greatest customization and convenience. This means whenever, wherever, real-time access to your accounts, plus flexible products and nimble services to stay ahead of your evolving needs.

By leveraging agile technology and uber-customization, we put customers in control of their finances and their lives.

FAQs

But why pay a fee for your paper statement? Sign up for online statements and you can get them faster, without the fees. Your online statements will continue to remain available through your online banking.